PAYROLL SOFTWARE

Payroll Management Software

Highlights

+ Complete Data Management of Employees.

+ Timely Payout of Salary.

+ Quick Start with Data Import option.

+ Achieve statutory accuracy to the maximum level.

+ Improve communication with employee.

+ MIS Reporting made easy with Report Writer utility.

Payroll Software is very simple, flexible and user-friendly Payroll Management software that takes care of all your requirements relating to accounting and management of employees’ Payroll. Payroll Management Software stores complete records of the employees, generates Pay-slips and Attendance Register, Computes all allowances and deductions and generates all Statutory and MIS reports.

Payroll Management Software offers very high flexibility in defining various allowances, deductions, leave rules etc. for the employees and all formulae for P.F., F.P.F., E.S.I.C., Profession Tax, Income Tax etc. are definable and changeable at User's end.

Payroll Management Software is compatible with Swipe Card Machines, Accounting Software’s and ERP Software and an interface can be provided for import/export of data. At present, Our Payroll Management Software is being used by over 1800+ User installations across India. The users include ET500 clients, small and medium enterprises, MNCs, Banks & Corporate.

Key Features

+ Designed for Windows XP / Vista / Win 2000 or above

The system is designed for windows as OS to enjoy the user friendliness of GUI with front-end as VISUAL BASIC and MS Access / MS-SQL Server / Oracle as backend to have a power of RDBMS.

+ Compatible with ERP / Accounting Solutions

This software has interface with Accounting Package like Tally, and can be made compatible with any other ERP / Financial Accounting software.

+ No Customization required for general requirements

Payroll Management Software has a configurable system where no change in the source code is required to work in any company or industry. It can handle the most complex payroll requirements, hence no customization required for general requirement. This means that you have the security of using a "package" which is supported by the developer, as against running the risk of getting involved with a tailor-made solution.

+ Multi User / User Level Access

Payroll Management Software is multi user software working with windows networking technologies like Peer-to-Peer or Win NT (TCP IP). Database can be accessed by the Local as well as Remote location. The Software also has multi user level definition whereby any user can be restrained from accessing any information other than super or admin user.

+ Minimum User Entry

Payroll Management Software ensures that minimum data entry has to be done for processing payroll. The software is compatible with SWIPE CARD or Time Recording machines from where the month end summary data of attendance can be downloaded into software for payroll processing.

+ Report Writer

- Payroll Management Software has a very flexible report writer built into it. Besides all the statutory reports and monthly pay slips, payroll sheets and other standard management reports, the user can design their own customized reports by selecting any of the fields within the reports.

- Report writer tool is also available in Employee Master to generate any combination of data for any complex report.

+ Import Data / Export Data

- This functionality gives the power to this software, whereby you can import your master & processed data from your existing payroll system or excel sheet through a text file. This reduces the time of implementation of the software.

- Reports and master data can be exported to other format like excel sheet or word document or PDF file.

+ Multi Company

Payroll Management Softwarecan be used for more than one company i.e. separate data can be maintained for your different setup and different location or within the same location.

+ Leave Management

- Manual calculation of leave is no longer necessary. You can predefine annual leave available to employee. Definition can be made for total leave for a year or monthly increment basis.

- Different type of leave management is possible like SICK, PREVILAGE, CASUAL LEAVE and OTHERS.

- Different leave setup for different Grade is possible.

- Monthly increment of leave can made possible on pro-rata basis of days present.

- Automatic leave balance calculation with carry forward to next year with prior setup of maximum leave.

- You may generate a Leave History Report for any employee.

- Balance Leave report.

+ Loan management

- Management of different loans given to employees.

- User definable loan name.

- Automatic interest calculation for Loans.

- Auto/manual deduction from pay-slip till full recovery of loan.

- Month-wise Breakup Report for installments deducted.

- Interest Calculation / EMI Calculation.

- Perks to be calculated on subsidized interest of Loans.

+ Reimbursement Management

- Reimbursement Type & Period can be set.

- Limits can be set on the basis GRADE / EMPLOYEES.

- Limits can be also set as Predefined Value or Monthly incremented figures.

- Reimbursement can be also connected to events.

- User definable payment option.

- Detailed ledger can be generated on payment history & voucher submission.

- Direct link to tax module to calculate accurate tax liability.

+ Income Tax Management

- Provision for considering past emoluments in case an employee joins in between.

- Provision for storing projected investment amount declared by the employee (This is used to calculate the TDS for the month).

- Investment variance report can be generated if investment declared & made details defers.

- Income Tax Projection with expected TDS to be deducted from the current Month’s Salary.

- Expected TDS Amount can be directly transferred to current months payroll processing.

- Adhoc TDS deduction facility on special payments like incentive or bonus.

- Generation of Form 16 / 16 AA, Form 12-BA, Form 24 – 24Q and ITNS 281 Challan of Income Tax.

- Previous years investment details of individual employee can be directly copied in current year to avoid re-entry of huge transactions. (OPTIONAL)

+ Standard / User Definable Letters

Payroll Management Software is equipped with the customized word pad. The user can draft the letter and can store it with reference of the employee for easy access in future. It also provides standard letter i.e. Appointment Letter, Confirmation Letter etc.

+ HRIS Functions

- Employee Personal Information.

- Employee Previous Job Experience.

- Employee Previous Job Salary Details.

- Employee Qualification Details.

- Employees HEAD Count Report with Multiple Combinations.

- Special Reminders on Daily/Monthly/Quarterly/Half Yearly/Yearly Basis.

+ Arrears Calculation

- Payroll Management Software automates the whole arrears process without any human intervention saving enormous amount of time. You may set up rules for each allowance and deduction whether they affect arrears or not.

- Auto calculation of arrears for any retrospective effect & to be paid in current month.

+ Reports with Payroll Management Software

These are the list of reports available with the Spine Payroll. It also has REPORT WRITER tool by which user can create any type of report & save it.

| Monthly Reports | Yearly Report |

| Various types of pay-slip format | Month-wise comparison report |

| Emailing of Payslip to employees in EXCEL / PDF or HTML format | Salary Reconciliation Statement with breakup till employee level |

| Emailing of Income Tax Projection to employees in EXCEL / PDF or HTML format | Voucher Printing |

| Various types of Pay-sheet / Register | Bonus Register |

| Supplementary Pay-slip & Register | |

| Arrears Pay-slip & Register | |

| Attendance Report | |

| Attendance and Leave summary | |

| Leave Ledger | |

| Statutory Reports | M I S Reports |

| ESIC Challan | CTC Report Employee wise |

| ESIC FORM 6 | CTC Report with multiple selection |

| ESIC FORM 7 | Reports on Promotion |

| P. F. Challan | Increment history report |

| P. F. FORM 6 A | Bonus Calculation Report |

| P. F. FORM 3 A | Gratuity Report |

| P. F. FORM 5 | Arrears Calculation |

| P. F. FORM 5 A | Projected Final Settlement |

| P. F. FORM 9 | Actual Final Settlement |

| P. F. FORM 10 | Recoverable Asset Management |

| P. F. Ledger | Birthday / Anniversary Reminder report |

| P. F. Register | Bank Payment Report |

| P. F. Branch wise EDLI & PF, FPF Reports & LWF Form A 1 | Cash Payment Report |

| Prof. Tax Challan | Cost of Department Report with Head count |

| Prof. Tax FORM 3 | Cost of Branch Report with head count |

| Prof. Tax PART 1 B | Interest calculation on loan |

| Income Tax Projection | Employee in Service years report |

| T. D. S. Report | Lock / Unlock Month |

| Income Tax FORM 16 / 16AA | Journal Entry |

| Income Tax FORM 12-BA | Chart & Graphical representation of payroll data |

| Income Tax FORM 24 – 24Q (E-Filing) | User Definable payslip setting |

| ITNS 281 Challan | |

| Bank Text File / Statement |

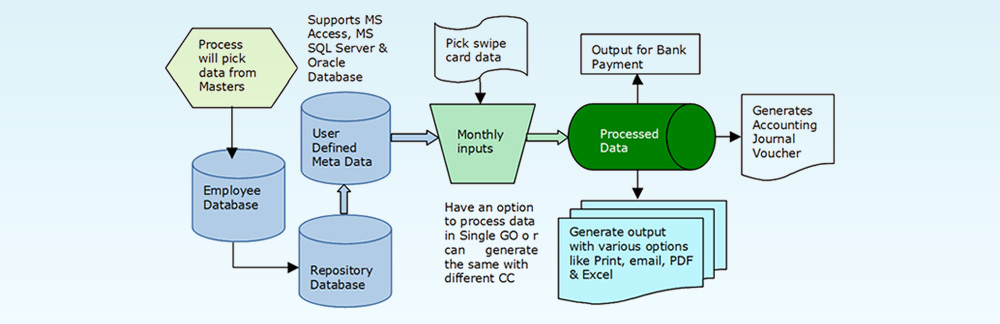

Payroll Management Software - Process Chart

Service & Support

SPINE ensures successful and efficient implementation of software by offering the optimum level of training to user with experienced consulting and technical support team. We are committed to support our customers with high quality training services and we do this through dedicated training session.

Building on extensive domain knowledge and continuous investment in leading edge technologies along with continuous involvement of clients experience and feedback. Payroll Management System has achieved one of the best practical software solutions for Payroll and Fixed Assets Management System.

Software Requirement

Operating System

- Microsoft Windows XP Professional with Service pack 2

- Microsoft Windows Server 2003 Standard Edition with R2

- Microsoft Windows Server 2003 Enterprise Edition with R2

+91 93269 90362

+91 93269 90362